malerapasso

Insurance is a sensible part of any financial plan. Good insurance should be designed as a temporal tool. For example, you purchase life insurance during a specific period of your life when your dependents would be financially devastated by your death.

That’s why term life insurance is almost always the right option for life insurance – it’s designed to cover a specific long period of your life when your dependents are most likely to be adversely affected by your death.

The 20-year term life insurance is a long-duration instrument with a negative expected real return, except in the event of death, in which case it exhibits a very asymmetric and sharp positive real return.

You are buying a long-term asset that is designed to lose money, but will create a very large short-term real return in the case of an aberrant risk event.

Investment portfolio insurance is a more interesting thinking exercise. In our All Duration model, instruments such as options, gold, managed futures, long treasury bills, and cryptocurrency all exhibit similar characteristics to insurance.

In other words, they often show long periods of low real returns, but in specific and unusual environments, they often generate very large short-term returns. This makes sense because each of these instruments typically insures against very specific elements such as tail risk, inflation, deflation, and fiat currency risk.

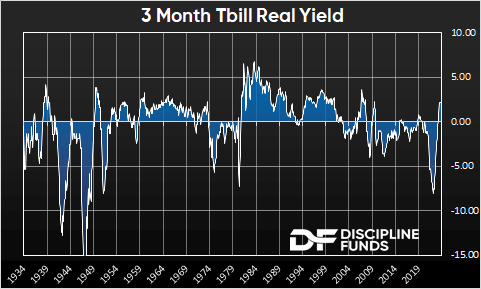

But in a world of positive real return cash, the story changes. After all, insurance is designed to provide you short-term certainty around an uncertain aberrant event. And when cash is producing a high real return, I think you can say that cash is the ultimate portfolio insurance.

A popular article published in 2017 described how Treasuries outperformed most common stocks:

Four out of seven common stocks that have appeared in the CRSP database since 1926 have lower lifetime buy and hold yields than one-month Treasury bills.1

This is true, in large part, because Treasuries have posted high positive real returns for most of the past 90 years. When Treasury bonds have positive real yields, your financial certainty is very high.

When treasury bills have negative real yields, financial certainty tends to be low. Indeed, the Fed will maintain a very unusual policy when real yields are low.

For example, financial uncertainty has been relatively high over the past 25 years because we have had a series of ups and downs around the Nasdaq, GFC and Covid bubble.

The Fed therefore remained exceptionally flexible for much of this period, resulting in low real Treasury yields. Low inflation resulted in a policy that literally tried to force people out of money and into other instruments.

These are times when broader diversification makes a lot of sense, as the unusual environment results in negative real cash returns and uneven returns between stocks and bonds.

This story changes significantly when cash generates a high real return like today. In other words, when cash generates a high real return, it becomes the ultimate insurance instrument because it provides you with a risk-free, risk-free return against short-term inflation. And it’s the ultimate form of financial certainty.

1 – Bessembinder, Hendrik (Hank), Do Stocks Outperform Treasuries? (May 28, 2018). Journal of Financial Economics (JFE), forthcoming, available on SSRN: Do Stocks Outperform Treasury Bills? or are equities outperforming Treasuries?

Original post

Editor’s note: The summary bullet points for this article were chosen by the Seeking Alpha editors.