The next creation of the 2.0 layer of Web 3.0 is characterized by the advancement of digital finance and the unwavering rise of technology in the global market. A problem can generate countless conclusions that can lead to countless solutions, whether they make life easier or not. With the help of chatbotGPT and Google search (Blackbox AI), the history of the Internet is well known. I’m not writing about AI protocol, but that’s the future. Blockchain is a technology that is here to stay in terms of societal progress. Most of the world powers fight against this technology because they don’t make as much money from it as the local banks.

I can’t speak for everyone, but because of the way they think, not everyone is aware of the nature of blockchain or hasn’t discovered it. Creating projects that access the testnet, node protocol, deploying contracts, and so many other things makes this space confusing and needs more explanation (education).

Whether privately owned or not, the government still controls local banks through its rules and regulations. According to the theory of social stratification, the lower middle class or lower class is actually affected by this rule and order. A shortage of money occurred during this period and local banks suffered badly before the start of previous Nigerian elections. Many Nigerians have been unable to access their money. Many citizens from various parts of the country lost their lives during this time. Why was it impossible for the Nigerian government or the central bank to solve these problems at the time? This is because the Nigerian government has already taken control of the power center of the financial system, which is causing the local banks in the home region to act like a zombie. This should serve as a warning to local banks at this time. What the outlet charges for withdrawals is not important to discuss. Due to massive manipulation by national banks, I said blockchain technology is here to stay. I was able to handle some transactions from the blockchain network during this time without feeling stress, and some savvy vendors who really understood the educational nature of blockchain took advantage of it.

Tekedia Mini MBA (September 11 – December 2, 2023) opens registration for a new edition. The cost is N90,000 or $170. Beat the early risers for discounts and perks. Register here

Join Tekedia Capital Syndicate and co-ininvest in the best startups in Africa here.

This summary will help you better understand the subject we are going to explore;

Native Bank Technology Properties

Anything generally accepted as a medium of commerce or other form of financial obligation is considered money. The brilliant economist discussed and highlighted the history of money and its applications so that everyone can understand how invaluable and important it is. Based on research that promotes learning and development, local banks have implemented new laws and policies because outdated methods of saving don’t work and lead to a decline in the value of currency. However, education enables consumers to begin using their local banks to save and invest in bonds, fixed income securities and other investment needs. However, I have embraced this innovation so far and still use it because new technology cannot instantly replace or subvert old technology. I don’t want to criticize the local banks, but their relationship with the government is like that of a monkey and a banana.

The upper and middle classes benefit from this approach while the common user is seriously harmed by the manipulation of local banks. This is called the centralized nature of banking. A centralized banking system basically means that the decision to approve or reject every transaction that occurs within the system is up to them.

All user data is under their control for easy handling

Indigenous banks have made important contributions to society as a whole, enabling the general public to feel secure and believe in the value of saving. The establishment of native banks is a strong incentive for individuals to stop storing their valuables, such as gold, diamonds, native currency and other precious materials, in their homes. Through the study process, this technology has provided solutions to a myriad of problems, and it has also brought a number of innovations that have given consumers greater confidence in their local banking system. the introduction of electronic banking services like mobile banking, ATMs and others.

Blockchain technology was created as a result of constraints in native banking transactions

The same theory can enrich several creations and innovations to solve problems that can be on the good or the bad side. Blockchain technology is created by a native bank through an anonymous protocol. I believe that there would be no need for research if there were no problems. Humans tend to solve problems, create things, and develop things that will lead to a better existence. Nothing worthwhile – good or bad – comes easy and takes a lot of effort to accomplish.

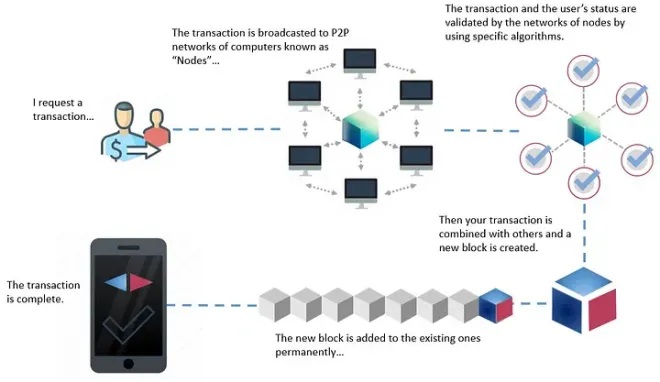

Blockchain technology was created following native banking system protocols on transactional policy, western payment policy, US payment policy, cross-border transfer barriers, government policy, bank liquidation, fees and min/max withdrawal. Although some people have used this technology on the dark web, where physical science is changed, ever since Satoshi, the individual credited with creating Bitcoin, first introduced it to the world. To complete an offer, these people engaged in a peer-to-peer transaction on the dark web. However, examining the history of cryptocurrencies will bring you to your knees when you realize that they were originally used as a payment method on the dark web.

The simple definition of money as it is used for payments and other commercial obligations in general. It is no longer anonymous or legitimate as long as it is accepted globally. Well, some nations continue to struggle with blockchain technology to this day.

In terms of financial transaction protocol, blockchain technology only facilitates transactions more than native institutions, but the nature of blockchain transactions and their use requires a clear and educational explanation for the user. 90% of individuals feel more comfortable using a local bank for their transaction, as they perceive it to be more trustworthy and reliable given the way locals protect the interests of citizens and enforce respect the law. However, you cannot do everything.

Does the local bank go bankrupt?

It may depend on the technology, but new technology never completely surpasses old technology. However, as you can see, the banks native technology is here to stay and will eventually become obsolete. 90% of people in the world use local banks for their regular financial transactions. All users must have the attitude that creating a bank account is absolutely important to carry out their daily transactional activity. Yes, local banks are more often seen as trustworthy financial institutions than blockchain technology. While discussing blockchain technology with a buddy yesterday, he replied that he had no idea what I was talking about but having a native bank account was 100% necessary.

Even the supposedly poorest members of Nigerian society joke about opening a native bank account. I haven’t seen anyone in Nigeria without a native bank account. These examples show how local banks have made significant and ongoing contributions to local and international communities to secure their assets and properties. Blockchain is still a young technology, and because banking is a native technology, the native will still exist 100 years from now. Native Bank’s motto is “War comes and goes, but our land remains our land”.

Why Are There Many Government Policies Around Blockchain Technology?

I believe that government policies have influenced international trade, allowing government to tax its way to a better understanding of the nature of production and development. The world government legally adopts and protects technology that benefits it. Due to its anonymous nature, blockchain technology continues to generate headaches for governments around the world.

Any land on which you personally discover gold is the one you must secure and protect until you get it all out. This is how some businesses, especially those that provide goods and services, and some technologies are regulated by the government.

Whether due to the anonymity of blockchain technology, the many wallet loss trends, or protocol fraud, the official and legal world government gains nothing. The reason the government hated blockchain technology was that they could never influence it. The main cause of this animosity is that. They made an effort to learn how transactions are processed and who is responsible for managing them. However, the nature of the technology has remained anonymous since the dark web. However, they enforce regulations requiring blockchain technology to have a KYC mechanism. Now for the summary.

In conclusion, as a beginner, I am interested in learning how to create money and how to manage it as well.

Blockchain and local banks are essential to human financial existence. All you have to do is accept and familiarize yourself with the process to know how to do business while exceeding regulatory regulations.