During the month of June, investors who engage in crypto trading will face three major hurdles. Indeed, these hurdles could impact the crypto market.

These issues include a worrying decline in trading volume, alarming liquidity issues, and a substantial increase in selling pressure.

Trading volume drops

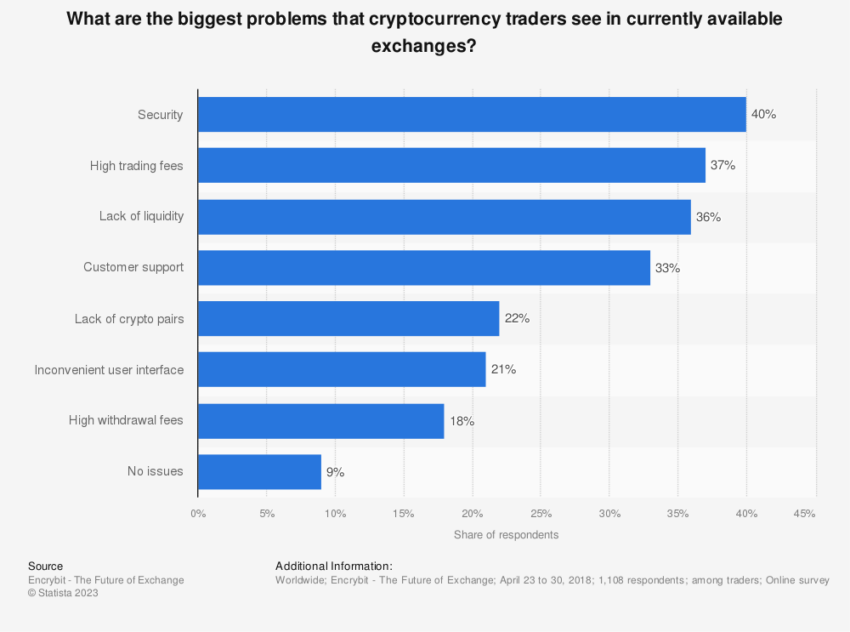

Trading momentum and expectations were high in the first quarter of the crypto market this year. However, a worrying decline in trading volume on all major centralized exchanges has since been observed.

May’s aggregate daily trading volumes fell from an impressive $23 billion to a paltry $9 billion. This downward trend signals diminishing speculative interest and growing apathy towards the crypto market.

“Daily crypto trading volume is now the lowest since 2020. The market as a whole is in a period of apathy and capitulation over time – the lack of speculative interest from the masses is creating opportunities for those who firmly believe in it, said analyst Will Clemente.

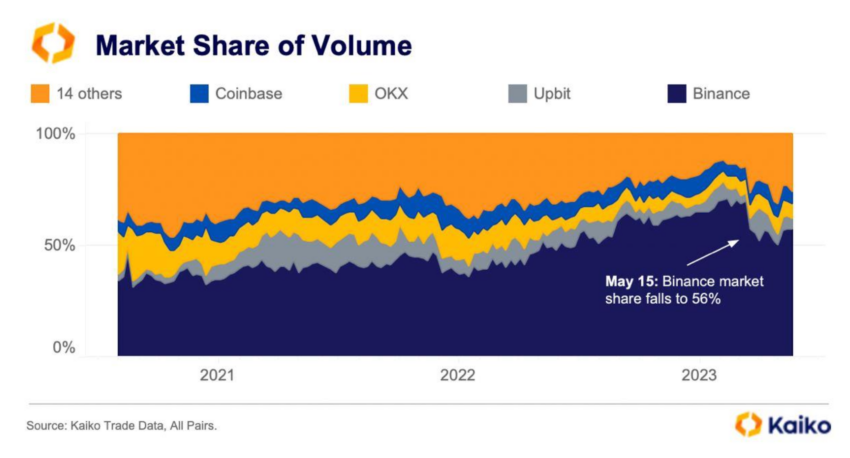

When it comes to the breakdown of overall trading volume by exchange, Binance has seen a slump. Its market share plunged to 56%, a sharp drop of 15% from its peak in the second half of 2022.

On the contrary, this drop has favored exchanges in the other categories, which include platforms such as Huobi, Kraken and Kucoin.

With the regulatory landscape in the United States remaining uncertain, offshore exchanges maintain their dominance in the crypto trading ecosystem. They account for 86% of all trading volume. This trend is expected to intensify.

Surprisingly, even Coinbase, traditionally recognized as a compliant alternative to other crypto sites, has announced the introduction of its own offshore derivatives site, the Coinbase International Exchange.

Crypto-liquidity crisis

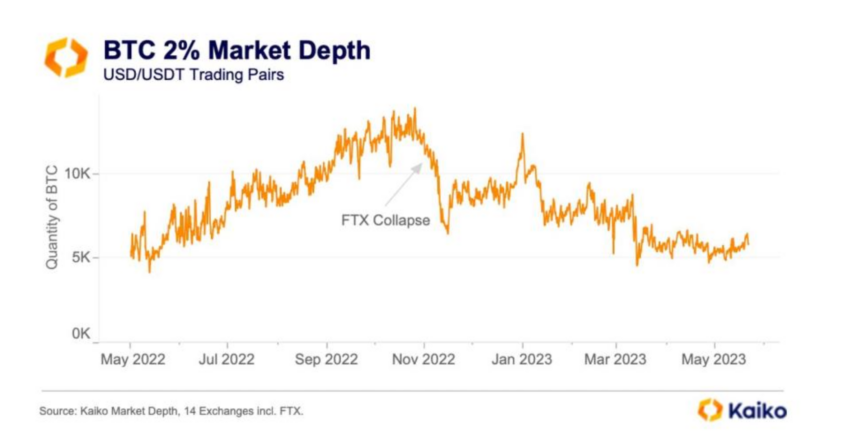

The second major issue casting a shadow over the crypto market is a liquidity crunch. This is especially important for Bitcoin and Ethereum.

Although the depth of the USD-denominated market remains somewhat stable. Liquidity remained stable, as measured by 2% market depth in coins, meaning the depth of bids and asks within 2% of the current trading price. This reflects a growing indifference towards the crypto market.

The continued decline in liquidity prompted statements from Jane Street and Jump Crypto, two market makers, revealing plans to scale back their U.S. crypto operations due to regulatory uncertainties. Jane Street went further by announcing a global reduction in its crypto operations.

The implications of reduced liquidity in the crypto market are significant. Liquidity is an essential aspect of any financial market, including crypto. It refers to the ease with which assets can be bought or sold in the market without affecting the price of the asset.

High levels of liquidity create a safer and more efficient market. Therefore, allowing participants to easily enter and exit trades leads to tighter spreads.

In contrast, low liquidity can hamper the ability of market participants to execute larger trades without incurring a price impact, also known as slippage.

Concretely, if a trader wants to sell a significant amount of crypto and there are not enough buyers, it may be necessary to lower the price to make it attractive. This process could create a downward price spiral, leading to lower prices and possibly triggering a selloff.

Increased sales pressure

The third issue presented in June 2023 is the spike in selling pressure as Bitcoin fell below $27,000.

While the crypto community keeps a watchful eye on crucial price levels, concerns over liquidity have been amplified following legislative actions in the United States.

Antoni Trenchev, managing partner at crypto lender Nexo, brought up an interesting point.

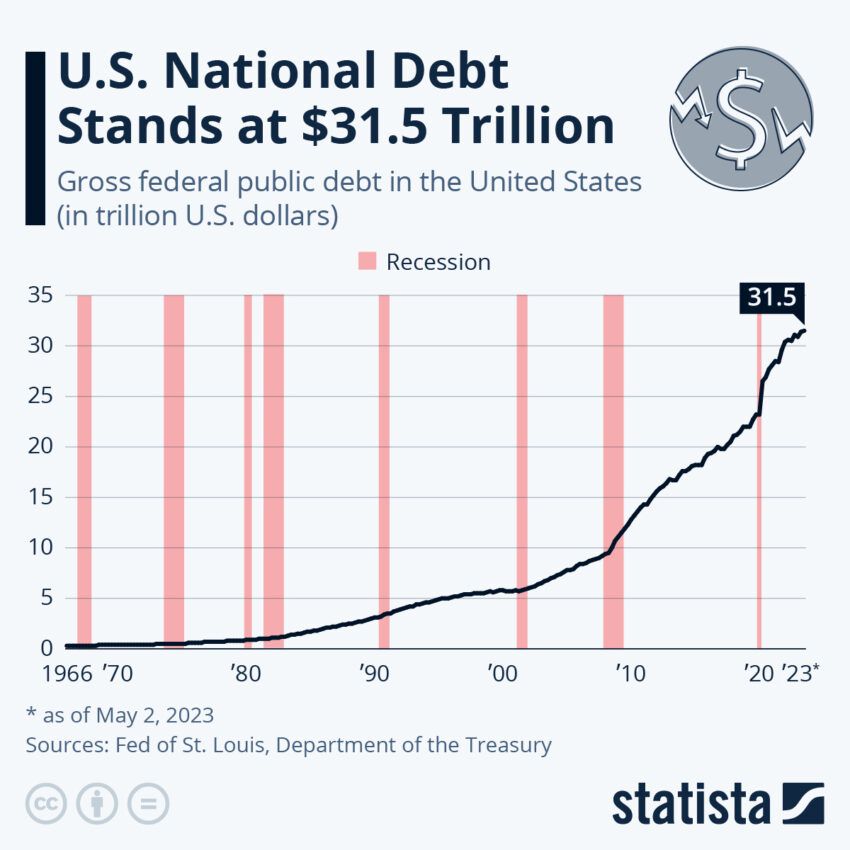

“Bitcoin faces a number of potential banana peels in June now that the debt ceiling drama seems to have passed. to a flood of Treasury bond issuance, which will likely draw liquidity from risky assets like Bitcoin,” Trenchev said.

The US House of Representatives recently approved an agreement to suspend the $31.5 trillion debt ceiling. This could lead to the issuance of up to $1 trillion in US Treasury bonds, which would put additional pressure on Bitcoin.

“For Bitcoin, it’s pretty simple: stay above the 200-week moving average around $26,300, and the uptrend from the November low of $15,500 is intact. On the upside, get past $31,000 and things might start to get really interesting,” Nexo’s Trenchev remarked.

However, Maartunn, Community Manager at CryptoQuant, believes that despite the recent spike in selling pressure similar to previous selling, it may soon peak and return.

Disclaimer

Following the guidelines of the Project Trust, this feature article presents the opinions and views of experts or individuals in the industry. BeInCrypto is dedicated to transparent reporting, but the opinions expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should independently verify the information and seek professional advice before making any decisions based on this content.