Despite what was advertised, the unspoken case (in public advertisements and Twitter) for crypto in Africa, was to get rich and quick. Recent events show cracks and will hopefully introduce some humility.

Over the past three years, Africa has grown its class of crypto preachers who have joined the global chorus in singing the praises of blockchain money. Since the Bankman-Fried Icarus Act, the trajectory of the crypto moon has reversed globally. And even in Africa, the love affair with crypto was mostly a ZIRP (zero rate phenomenon). This does not mean that the camel’s back has already been broken. It just means it’s a lot easier to call BS. Wacky crypto stories are failing many gullible elders anymore. Except for the ultra-addicted.

“Many Africans have integrated crypto into daily life,” crypto-focused publication, CoinDesk reported in 2022. Coindesk’s source was a report by Chainalysis, the crypto research firm. The report claims $100.6 billion in transactions were recorded on-chain between July 2021 and June 2022. According to Chainalysis, “Crypto use is driven by daily necessity, as opposed to speculation by already affluent people. …especially in countries where the values of local fiat currencies are falling, as we have seen in Nigeria and Kenya.Any African can tell you that is demonstrably not true.

Crypto in Africa was supposed to have stronger use cases. Bitcoin could hedge against punishing and inflexible inflation in Africa. The crypto would protect the wealth of users when the value of currencies drops. But more importantly, Africans could now “participate in the global economy” by trading all manner of derivatives and crypto commodities. If you were enterprising enough, like the gentlemen who founded Wakanda Inu, you could even create and sell your tokens. Wakanda Inu, Africa’s “answer” to the popular meme token, Shiba Inu, has followed the path of all pyramid schemes, i.e. toilets.

Instead, Africa’s crypto path has been riddled with clumsy regulations, an abundance of frauds, scams and the like. And plenty of condescension from the world’s largest crypto exchanges and figureheads, who speak fondly, almost fatherly, of the need for crypto from the “global south” while consistently providing poor service to African or other crypto users. denying them service outright. The result is predictable. No more scams and scams.

I remember sitting in a cafe two years ago and finding out in a casual conversation with my neighbor that she was in the early stages of creating a new token and tried to recruit me. I joined the Telegram group of his “project” to witness first hand the development of a crypto “project”. Needless to say, her project, I forget the name now, failed to take off, despite vigorous campaigning by her and her foreign and local partners.

Several popular peer-to-peer crypto markets have recently halted operations. | Infographic: Ayomide Agbaje — TechCabal Insights

Far from being a mere store of value or hedge against inflation and currency depreciation, cryptocurrencies have fueled an epidemic of speculation in Africa. WhatsApp groups erupted as young Africans crammed in, hoping to get trading ‘signals’ to guide their margin trading. And the prophets predicted business fluctuations on social networks. Outside of the stablecoin model, the cryptocurrency craze in Africa, like its cousins everywhere else on earth, was built on zero utility and lots of hopium. He made some rich and popular. But it didn’t do much else. Although for some reason, CNBC thinks Bitcoin will “blow up the African banking system by $86 billion.”

Instead, over the past six months, the lack of cheap money occasioned by central bank rate hikes is forcing the cracks in the carefully crafted exterior of crypto to crack. After the collapse of FTX, which had a big ground game in Africa, with college ambassadors and a rural outreach program, three other Africa-focused crypto exchanges recently shut down, including Localcryptos, Localbitcoins, and more recently, Paxful.

Another one biting the dust

When Paxful announced its closure last week, Ray Youssef, 46, who served as founder and CEO, blamed the decision on “key personnel departures” and “regulatory challenges”. What he didn’t say was that the issues with his co-founder, Artur Schaback, had reached a fever pitch. Schaback had sued his partner and co-founder in January this year for, among other things, “an illegal scheme to avoid international sanctions on transactions to and from Russia”. Further details about Paxful’s sleazy backyard are contained in this CoinDesk report. But it’s instructive to note that until the sudden announcement of the exchange’s closure, Youssef gave no indication of trouble, as he posted bitcoin platitude after platitude sprinkled with political tweets, aligning himself mainly on one of Nigeria’s presidential candidates, Peter Obi. A significant portion of Obi’s supporters are mostly young city dwellers – the same demographic of users targeted by Paxful and other crypto services.

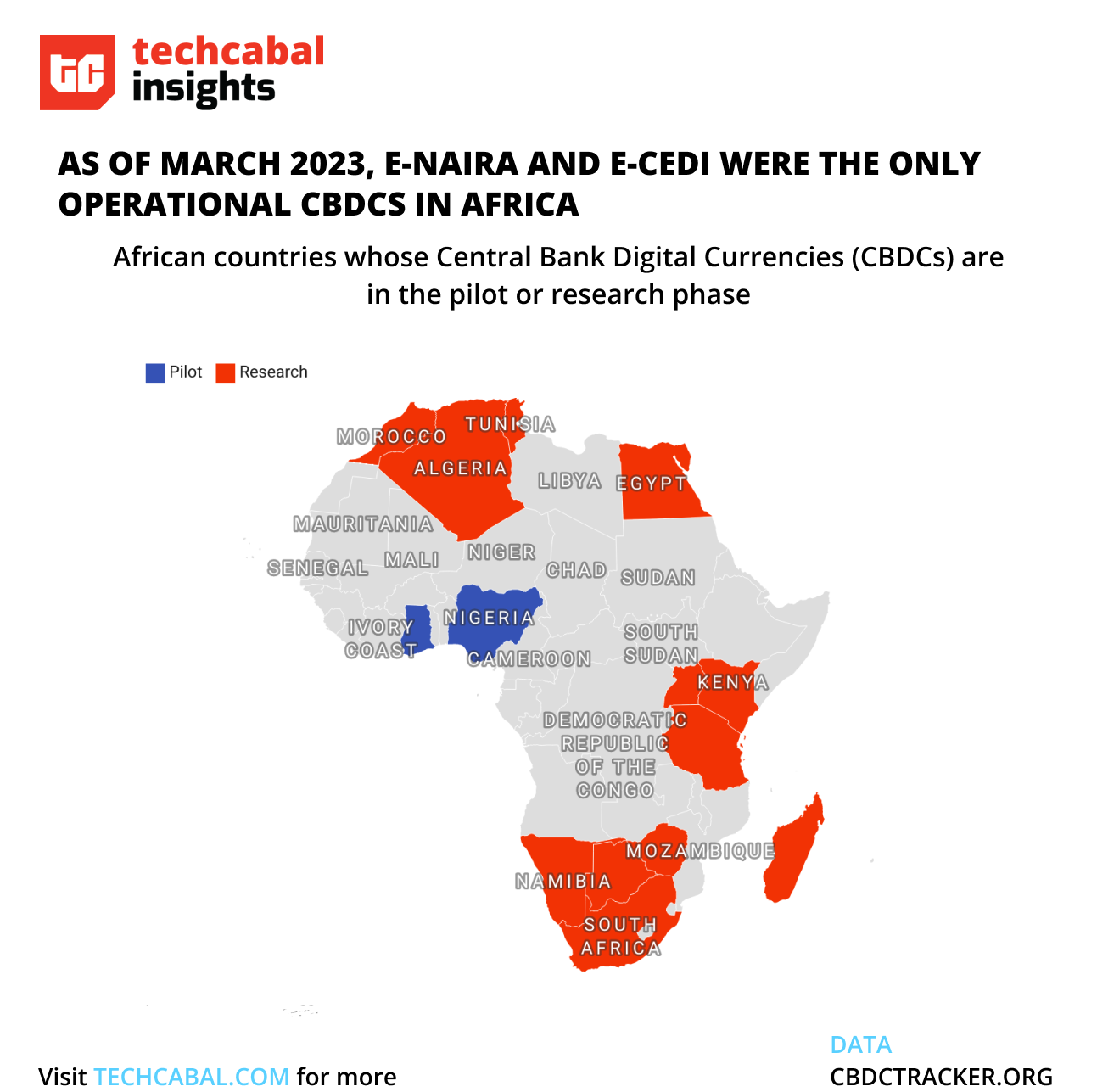

Several African countries are exploring the use of central bank digital currencies to improve payment systems. | Map: Ayomid Agbaje — TechCabal Insights

Arguably one of the most significant impacts of cryptocurrencies – globally – is the acceleration of retail central bank digital currency, aka CBDC. Indeed, the excesses of crypto-verse and the growing desire of governments to control every inch of the lives of their respective governed masses are part of the motive (and justification) of CBDCs. “. If you want to use digital assets, use eNaira. It has all the properties of a digital asset,” a central bank official in Nigeria joked.

Like FTX, the sudden shutdown of Paxful, which was closer to its users in Nigeria and Kenya, could force crypto users in Africa to question their investments. Or maybe not (for the most committed or the most scammers). Importantly, it is one less blocker in the conversation about the absurdity of Africa’s crypto history. It may be easier to call outright rackets that have never been called.

It is I who hope. If the crypto group I’m in is any indication, crypto patch dependency won the nibbling is still too strong.

We would like to hear from you

Psst! Here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh insights into the progress of digital innovation in Africa every Sunday.

Please share today’s edit with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay.

Subscribe to our TC Daily newsletter to get all the tech and business stories you need every weekday at 7:00 a.m. (WAT).

Follow TechCabal on Twitter, Instagram, Facebook and LinkedIn to stay engaged in our real-time conversations about technology and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

Tech Cabal.