Ethereum is a decentralized and open source blockchain platform with smart contract functionality, which has become the second largest cryptocurrency by market capitalization. Since its inception, it has attracted a wide range of investors, developers, and traders due to its innovative technology and growth potential. However, like any financial market, the ecosystem can be vulnerable to Ethereum price manipulation.

Despite growing concerns, there are ways to learn to recognize signs of Ethereum price manipulation and learn how to protect investments.

The issue of Ethereum price manipulation

How Price Manipulation Happens

Price manipulation is a deceptive practice where malicious actors intentionally influence the market price of an asset to their advantage. These players can achieve this by using various strategies, including spoofing, wash trading, pumping, and dumping.

The impact of price manipulation

Price manipulation can lead to distorted market valuations, losses for investors, and reduced confidence in the overall ecosystem. It is crucial to be aware of the signs and effects of price manipulation and to know how to protect yourself from falling victim to it.

Signs of Ethereum price manipulation

Sudden price movements

An indication of price manipulation is erratic and sudden price movements that do not match market trends. These can be short-term spikes or dips that seem illogical based on recent news or developments in the Ethereum ecosystem.

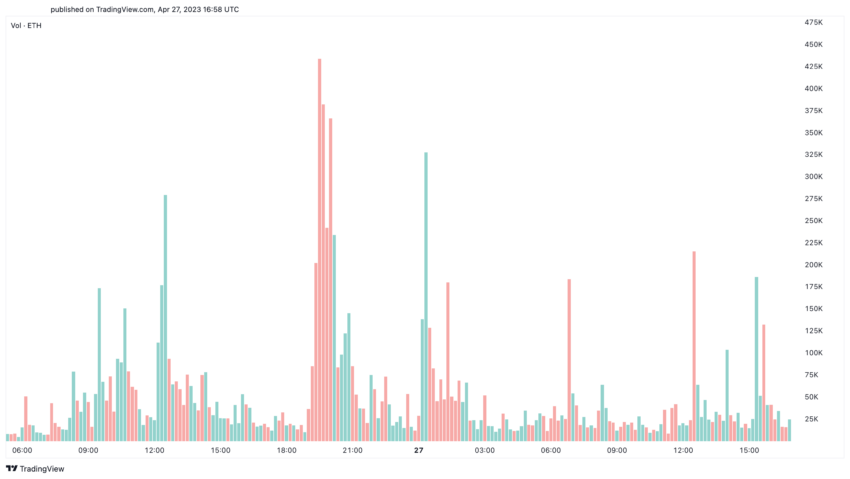

Concentrated trading volume

Another sign is a sudden increase in trading volume that is concentrated in a small group of traders or trading platforms. This could indicate that a coordinated effort is being made to manipulate the price of Ethereum.

Social Media Influence

Social media can also be used to manipulate prices by spreading misinformation or fake news to create hype around a particular asset. In the case of Ethereum, unscrupulous individuals can use social media platforms to spread rumors or fake news to drive the price up, only to sell once the price reaches the desired level.

The effects of price manipulation on Ethereum

Market sentiment and confidence

Price manipulation can harm overall market sentiment and trust in Ethereum, as investors may be wary of the legitimacy of the ecosystem. This can lead to reduced market participation and hinder platform growth and adoption.

Investor losses

Investors who are unaware of price manipulation strategies can fall victim to these schemes and suffer significant losses. It is essential to be vigilant and to recognize the signs of manipulation to avoid falling into these traps.

Regulatory implications

Price manipulation may also attract the attention of regulators, who may take action to impose stricter rules and regulations on the Ethereum ecosystem. While regulation can help protect investors, it can also hinder innovation and development within the blockchain industry.

How to protect yourself from price manipulation

Diversification

Diversification is an effective way for investors to protect themselves from the effects of price manipulation. By investing in a range of assets, including various cryptocurrencies and traditional investments, investors can reduce the impact of any single market event on their portfolio.

Research and due diligence

Performing thorough research and due diligence is essential when investing in any asset, including Ethereum. This can help investors better understand the fundamentals of the asset and make it easier for them to recognize signs of price manipulation.

Commercial Discipline

Maintaining trade discipline is also crucial to protect against price manipulation. This involves setting clear entry and exit points for trades and managing risk using stop-loss orders and properly positioned sizing. Avoid letting emotions dictate trading decisions, as this can make investors more susceptible to manipulation tactics.

Sum it all up

Ethereum price manipulation is cause for concern. This can lead to distorted market valuations, losses for investors, and reduced confidence in the ecosystem.

By being aware of the signs and effects of price manipulation and taking steps to protect against it, investors can minimize their exposure to these risks. As Ethereum continues to grow and evolve, staying vigilant and informed is crucial to protecting investments.

Ethereum is a decentralized and open source blockchain platform with smart contract functionality. It is the second largest cryptocurrency by market cap.

Price manipulation is a deceptive practice where malicious actors intentionally influence the market price of an asset, such as Ethereum, to their advantage.

Protecting yourself from price manipulation involves diversification, conducting thorough research and due diligence, and maintaining trading discipline.

Price manipulation can damage market sentiment and confidence, lead to losses for investors and lead to regulatory repercussions.

Being aware of price manipulation can help investors recognize the signs and effects of these deceptive practices, enabling them to take appropriate action to protect their investments.

Disclaimer

In accordance with Project Trust guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reports, but market conditions are subject to change without notice. Always do your own research and consult a professional before making financial decisions.