South Korea’s KEB Hana Bank is set to work with the Central Bank of Korea (BOK) on the latter’s CBDC pilot and stablecoin alternatives, such as tokenized deposits.

According to the Maeil Kyungjae newspaper, Hana Bank is now “actively participating” in the BOK’s ongoing CBDC proof-of-concept project.

The newspaper noted that the BOK and Hana will “actively participate in the preparation” of a “monetary system based on blockchain technology.”

The parties are now conducting “internal research” on the “symbolic deposits”.

Central banks have turned to popular stablecoins for inspiration from their own CBDC projects.

But they think they can do better by improving the design of conventional stablecoins.

They called these coins “private token currencies that circulate like bearer instruments.”

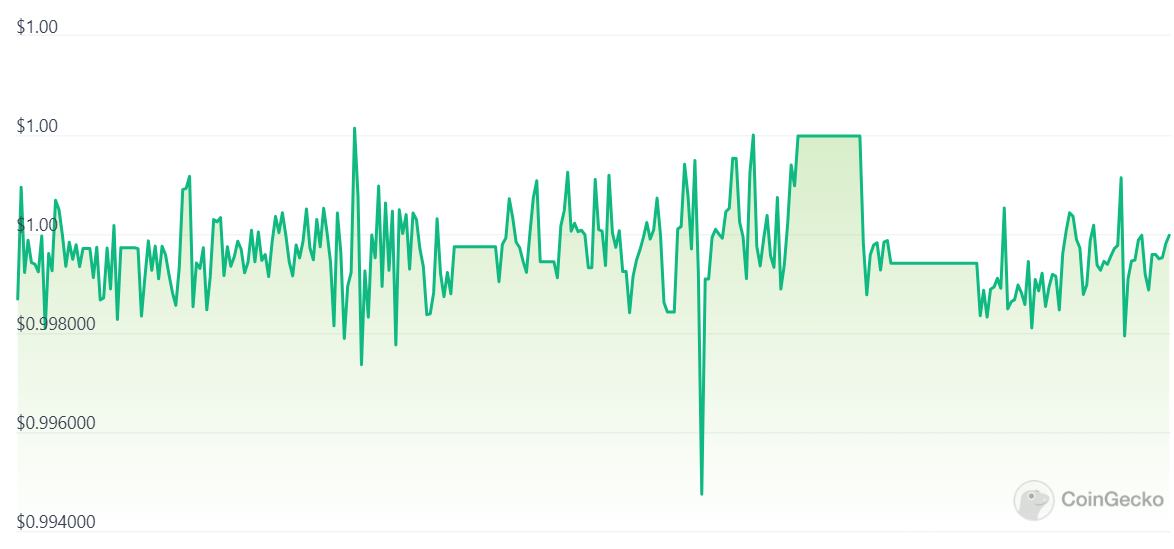

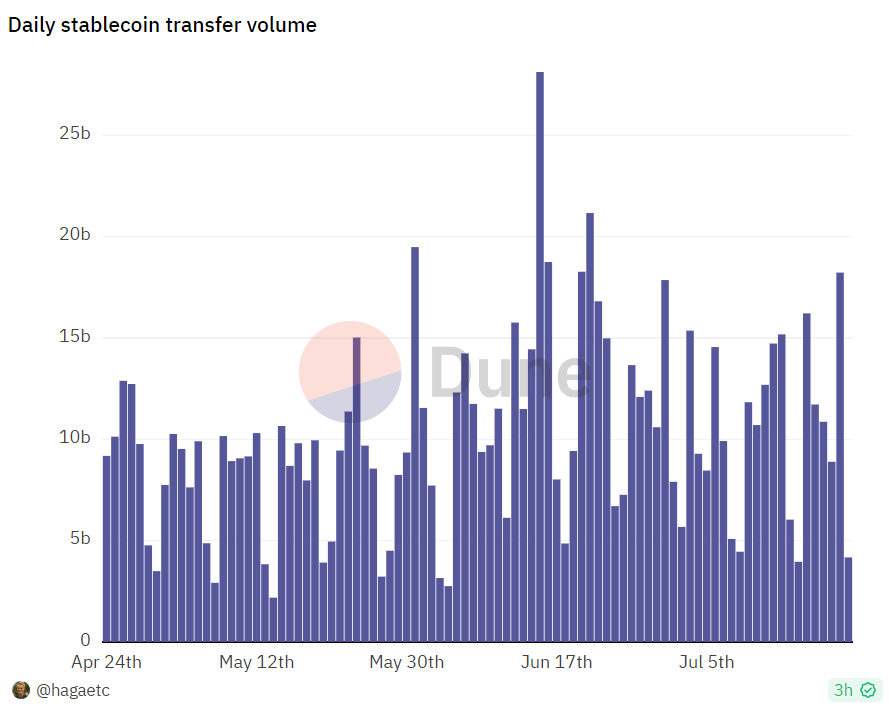

As De Blasis et al demonstrated earlier this year, popular stablecoins like the USD pegged USDT experience some level of price volatility.

And this volatility is something that central banks seem to want to avoid at all costs with their CBDC plans.

In April, the Bank for International Settlements (BIS) published an article on token deposits and their potential to displace stablecoins in the financial and banking sectors.

The BIS asserted that stablecoins “may cause deviations in their relative exchange values from par in violation of ‘the uniqueness of currency'”.

As an alternative, token deposits, also powered by blockchain, “do not circulate as bearer instruments, but rather settle in central bank money” and “are more conducive to uniqueness,” the BIS wrote.

The BRI also asserted that tokenized deposits can “enable expanded functionality by leveraging the capability of programmable ledgers to introduce contingent execution and composability of transactions.”

The BOK seems to have taken these recommendations to heart.

And South Korean commercial banks, seemingly worried about being left out of the CBDC’s image, seem eager to carve out a place for themselves in the space.

Hana has been exploring the blockchain space for about half a decade.

He has made inroads in blockchain-powered real estate and invested in research related to the crypto sector.

The BOK, meanwhile, is working with a number of commercial banking partners on the KRW digital project.

South Korea’s banking industry expresses interest in ‘token deposits’

Maeil Kyungjae called token deposits an “emerging hot topic” in the financial world.

The April BIS document was co-authored by Hyun Song Shin, a former economic adviser to the South Korean presidency.

Hana’s rival Woori Bank’s Woori Financial Management Research Institute also recently released a report on token deposits.

And the outlet noted that domestic commercial banks began “showing great interest in tokenized deposits” when BOK Governor Lee Chang-yong told attendees at a BRI event in March that “tokenized deposits are needed” in the banking industry.

Last month, Hana’s Management Research Institute predicted that the national security token market would reach some $27 billion next year.