Crypto investors will be watching key US economic data this week, including the US CPI, for clues on the Federal Reserve (Fed) policy decision due May 2-3..

Investors are hoping that the US consumer price index (CPI), producer price index (PPI), and jobless claims will build on Bitcoin’s 70% rally this year.

Analysts Predict Cooling CPI

Last month, the Federal Reserve signaled it would consider easing monetary policy amid signs that the US economy could be cooling.

FactSet analysts expect the US CPI to continue falling. A 0.3% increase in the CPI is expected when the data is released on April 12

February data suggested that US inflation was down, despite the US core CPI, which excludes food and energy prices, hitting a five-month high. The CPI rose 0.4% last month, with housing costs contributing 70%, a trend that is expected to continue in March.

Last month’s producer price index, a measure of wholesale price inflation, fell 0.1%.

The minutes of the Fed’s Open Markets Committee meeting of March 21-22 will be released on April 13. The minutes will outline the factors that led to the 25 basis point interest rate hike at the March meeting. They could also offer investors a preview of the Fed’s next move.

Bitcoin is expected to show some volatility after the release.

The shrewd investors will also tap into the meeting of several prominent finance ministers, including those from the United States and Europe, for clues about the next policy move at their April 10-16 spring meeting in Washington, D.C. .

Eastern economies like India and China criticized Western rate hikes, driving the federal funds rate from 4.75% to 5%, for contributing to the recent failures of US banks Silicon Valley and Silvergate.

Stronger oil prices dampen labor market optimism

Fed Chairman Jerome Powell said last month that a tight labor market was pressuring the central bank to keep raising rates to fight inflation.

However, seasonally adjusted job applications figures revealed the US jobs market was looser than Powell initially indicated, removing a key driver behind a further increase.

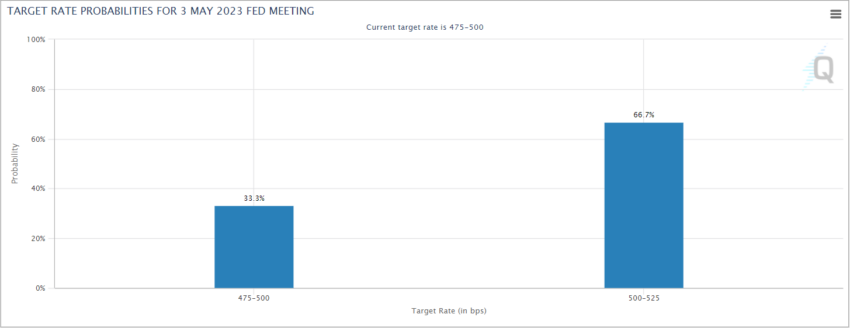

As a result, CME Group’s FedWatch tool predicts a 33.3% chance that the Fed will suspend rate hikes.

However, it also suggests a 66.7% chance that the central bank will raise rates by 0.25% at its next meeting. This scenario, likely to be influenced by the firming up of oil prices, will bring the overall rate to 5%-5.25%.

The recent collapses of Silicon Valley and Silvergate Bank will also likely weigh on the next Fed meeting.

High interest rates have prompted crypto-friendly banks to sell long-term Treasury instruments at steep losses to raise cash to honor withdrawals.

Silicon Valley Bank filed for receivership last month. Silvergate announced its voluntary liquidation in February, after a crisis of confidence triggered by the collapse of FTX last November.

To be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to providing impartial and transparent reports. This news article aims to provide accurate and timely information. However, readers are urged to independently fact-check and seek professional advice before making any decisions based on this content.