Have you ever wondered how crypto billionaires and business tycoons navigate the market? The altcoins they trade, their activity in DeFi protocols and the strategies they implement to grow their wealth?

On-chain data sheds light on the behavior of the wealthiest individuals in the crypto market. Hence, it provides valuable insights into their investment strategies, risk management, and lucrative opportunities.

Andrew Kang: Crypto Billionaire Instincts

Andrew Kang is on the list of crypto billionaires. He is one of the founders of Mechanism Capital and has a net worth of over $200 million. As a result, information about his on-chain strategies can be gleaned by tracking his public wallet address.

Kang made a large initial purchase of 795,120 ARB tokens worth nearly $1 million on April 4. Subsequently, he purchased 816,010 and 693,120 ARBs worth approximately $1.84 million on April 5.

Before the Arbitrum Foundation unveiled two new governance proposals on April 6, Kang had acquired 2.31 million ARB tokens. Then he sold all of his ARB holdings on April 19, generating an impressive 40% return on investment.

Lafa: Invest in Solidly and Ve(3,3) Tokens

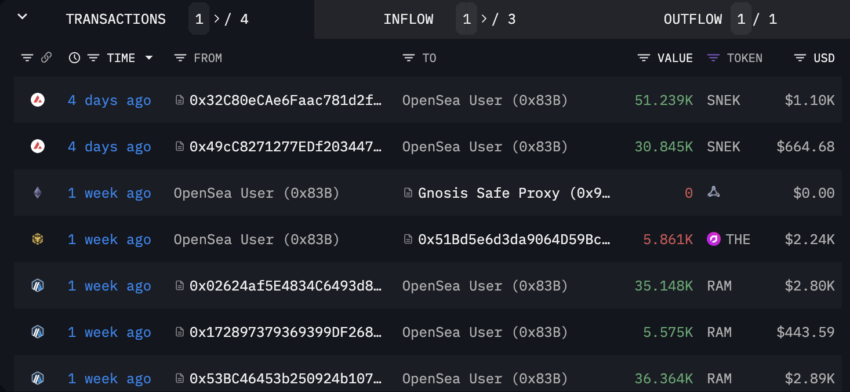

Lafa, the founder of the DeFi protocol DEUS, has a net worth exceeding $5 million. The public wallet address of this crypto-billionaire reveals investments in various DeFi tokens, in particular Solidly and Ve (3.3).

- $2 million in SOLID

- $560,000 in LE

- $185,000 in SNEK

- $372,000 in RAM

- $35,000 in EQUALS

These tokens haven’t performed well recently. However, Lafa seems to have placed his bets on the Solidly and Ve(3,3) tokens.

Justin Sun: DeFi Activities in the TRON Ecosystem

Justin Sun is one of the youngest crypto billionaires. He is the founder of TRON and has a net worth of over $400 million.

Tracking his public wallet address reveals his investments in various tokens:

- $850,000 in AAVE

- $286,000 in HRV

- $173,000 in COMP

- $165,000 in MULTI

- $156,000 in CLC

- $146,000 in MATIC

- $105,000 in KCS

- $103,000 in SUSHI

Sun actively participates in DeFi activities to grow its crypto wealth. By providing liquidity in DeFi, it contributes its assets to liquidity pools that facilitate transactions and exchanges on decentralized crypto exchanges. Therefore, he earns fees or rewards in exchange for cash, thereby contributing to the return on his investments.

Arthur Hayes: $GMX enthusiast

Arthur Hayes is another successful analyst who is on the list of top crypto billionaires. He co-founded BitMEX and has a net worth over $500 million.

Tracking his public wallet address shows his investments in various tokens:

- $44,000 in BONDS

- $31,000 in ETH

- $19,000 in PENDLE

- $14,000 in BRA

A closer look at its DeFi business reveals that it relies heavily on the decentralized crypto exchange GMX. Indeed, Hayes has staked a significant amount of funds in GMX and is earning returns:

- Stake $15.70 million in GMX

- Stake $1 million in Escrowed GMX (esGMX)

At a minimum, GMX provides Hayes with an APR of 4.32%, paid entirely in Ethereum (ETH), worth between $3,000 and $5,000 per day.

Hayes had a profitable performance staking most of his holdings in GMX. Therefore, keeping an eye on the on-chain activity and buying behavior of this crypto billionaire could provide significant opportunities.

Crypto Billionaires 2023: Buying and Staking Could Be the Answer

Tracking the on-chain activities of crypto billionaires reveals invaluable insights into their investment strategies, risk management, and the opportunities they take to grow their wealth. Indeed, these influential figures remain at the forefront, actively participating in various protocols and experimenting with new strategies.

Understanding how these people trade in the market can offer a wealth of knowledge to investors and crypto enthusiasts. Therefore, one must learn from their achievements and failures to develop a more informed and robust approach to investing in cryptocurrencies.

While it’s essential to remember that each investor’s risk tolerance and goals differ, understanding the stocks of top performers can be a guide in the complex and often volatile crypto industry.

Disclaimer

Following the guidelines of the Project Trust, this feature article presents the opinions and views of experts or individuals in the industry. BeInCrypto is dedicated to transparent reporting, but the opinions expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should independently verify the information and seek professional advice before making any decisions based on this content.