On April 17, 2023 at 09:44:37 ET, an unusually large $189,70,000 block of Put contracts in Riot Blockchain (RIOT) was sold, with a strike price of $13.00/share, expiring in 4 day(s) (April 21, 2023). Fintel tracks all large options trades, and the premium spent on this trade was 2.24 sigma above the average, placing it in the 99.31st percentile of all recent large options trades made on RIOT options. .

This trade was first detected on Fintel’s real-time unusual options trades tool, where unusual options trades are highlighted.

What is fund sentiment?

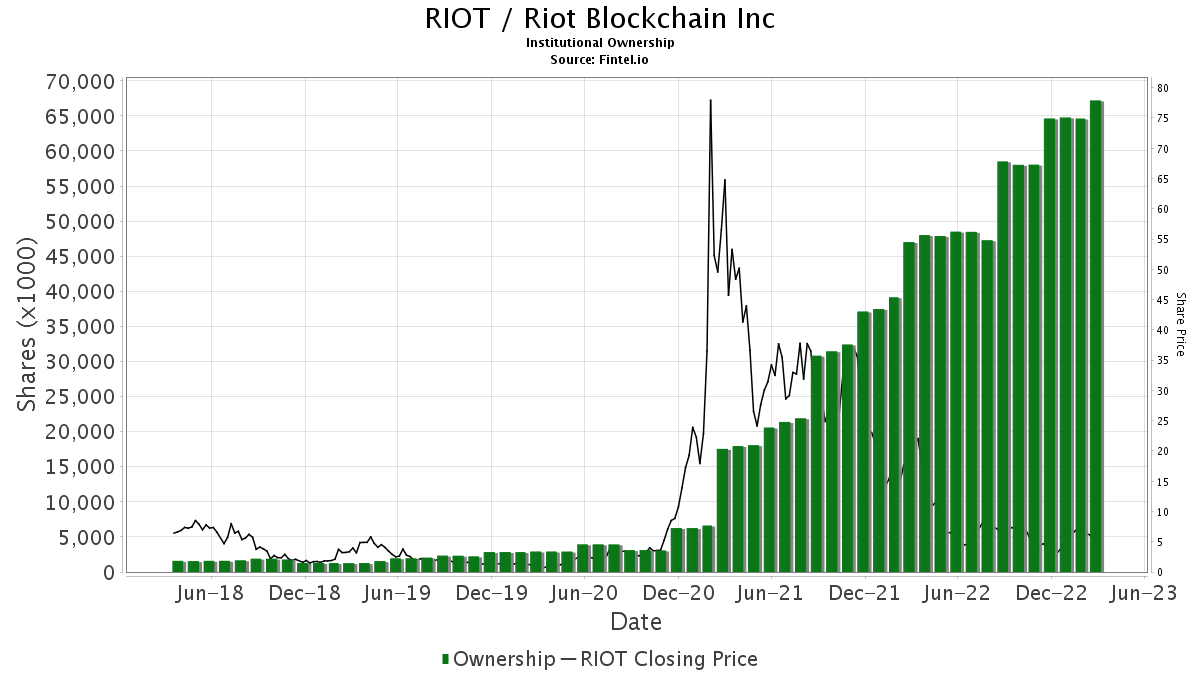

There are 400 funds or institutions reporting positions in Riot Blockchain. This is an increase of 18 owners or 4.71% over the last quarter. Average portfolio weight of all funds dedicated to RIOT is 0.27%, an increase of 9.39%. The total number of shares held by institutions has increased over the past three months by 7.03% to 69,317,000 shares.

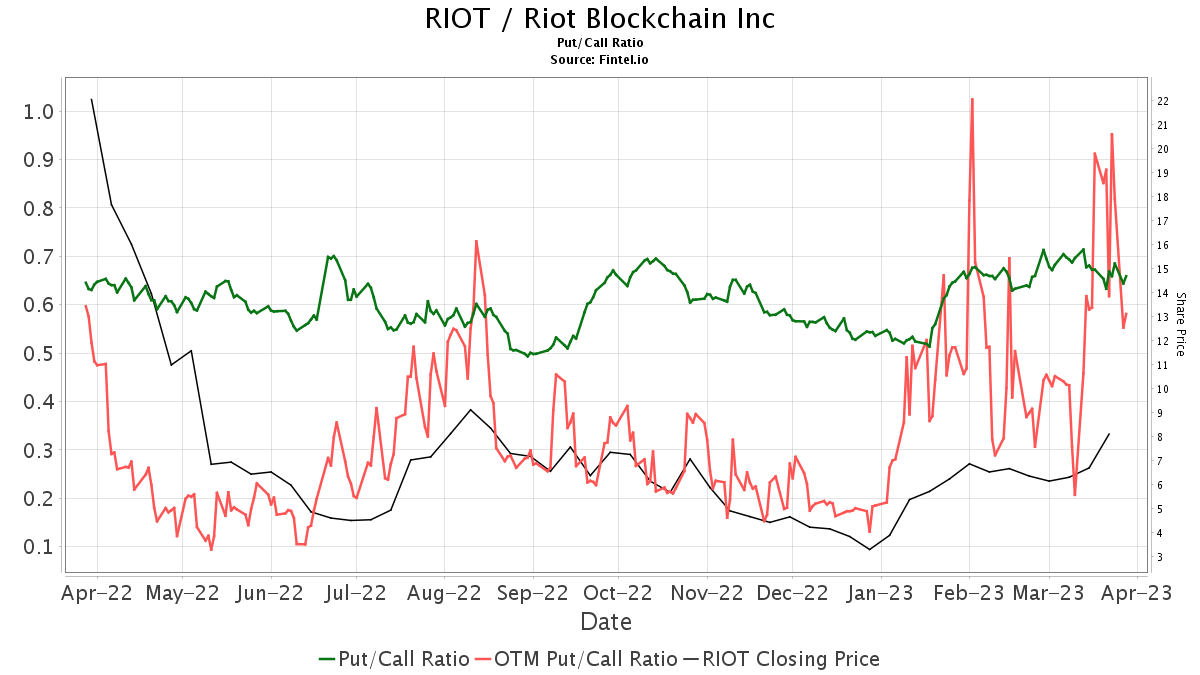

RIOT’s put/call ratio is 0.73, indicating a bullish outlook.

Analyst price predictions suggest a 28.40% drop

As of April 6, 2023, the one-year average price target for Riot Blockchain was $9.65. The forecast ranges from a low of $5.05 to a high of $12.60. The average price target represents a decline of 28.40% from its last reported closing price of $13.48.

Check out our ranking of companies with the biggest upward price target.

Riot Blockchain’s projected annual revenue is $424 million, an increase of 63.58%. Projected annual non-GAAP EPS is -$0.08.

What are the other shareholders doing?

Birch Capital Management holds 1,000 shares representing 0.00% ownership of the company. No change in the last quarter.

Sargent Bickham Lagudis owns 1,000 shares representing 0.00% ownership of the company. No change in the last quarter.

IWM – iShares Russell 2000 ETF holds 3,654,000 shares representing 2.19% ownership of the company. In its previous filing, the company said it held 2,964,000 shares, representing

a raise

of 18.88%. The company

decreases

its portfolio allocation in RIOT by 46.01% in the last quarter.

Van Eck Associates holds 542,000 shares representing 0.32% ownership of the company. In its previous filing, the company said it held 463,000 shares, representing

a raise

of 14.51%. The company

decreases

its portfolio allocation in RIOT by 50.89% in the last quarter.

Brighthouse Funds Trust II – MetLife Russell 2000 Index Portfolio holds 54,000 shares representing 0.03% ownership of the company. In its previous filing, the company said it held 47,000 shares, representing

a raise

of 13.04%. The company

decreases

its portfolio allocation in RIOT by 46.45% in the last quarter.

Riot blockchain background information

(This description is provided by the company.)

Riot Blockchain focuses on bitcoin cryptocurrency mining. The Company is expanding and modernizing its mining operations by obtaining the most energy-efficient miners currently available. Riot also has some non-controlling investments in blockchain technology companies. Riot is headquartered in Castle Rock, Colorado, and the company’s main mining facility operates in upstate New York under a colocation hosting agreement with Coinmint.

See all Riot Blockchain regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.