Fintel reports that on April 12, 2023, Wells Fargo maintained coverage of Riot Blockchain (NASDAQ:RIOT) with a Equal weight recommendation.

Analyst price predictions suggest a 22.04% drop

As of April 6, 2023, the one-year average price target for Riot Blockchain was $9.65. The forecast ranges from a low of $5.05 to a high of $12.60. The average price target represents a decline of 22.04% from its last reported closing price of $12.38.

Check out our ranking of companies with the biggest upward price target.

Riot Blockchain’s projected annual revenue is $424 million, an increase of 63.58%. Projected annual non-GAAP EPS is -$0.08.

What are the other shareholders doing?

TLSTX – Stock Index Fund holds 3,000 shares representing 0.00% ownership of the company. In its previous filing, the company said it held 2,000 shares, representing

a raise

of 28.26%. The company

decreases

its portfolio allocation in RIOT by 36.42% in the last quarter.

Marathon Trading Investment Management owns 45,000 shares representing 0.03% ownership of the company. In its previous filing, the company said it held 51,000 shares, representing

a decrease

of 13.26%. The company

decreases

its portfolio allocation in RIOT by 43.36% in the last quarter.

Scotia Capital holds 41,000 shares representing 0.02% ownership of the company. No change in the last quarter.

Great West Life Assurance holds 18,000 shares representing 0.01% ownership of the company. In its previous filing, the company said it held 20,000 shares, representing

a decrease

of 9.80%. The company

decreases

its portfolio allocation in RIOT of 99.96% in the last quarter.

QCEQRX – Equity Index Account Class R1 holds 39,000 shares representing 0.02% ownership of the company. No change in the last quarter.

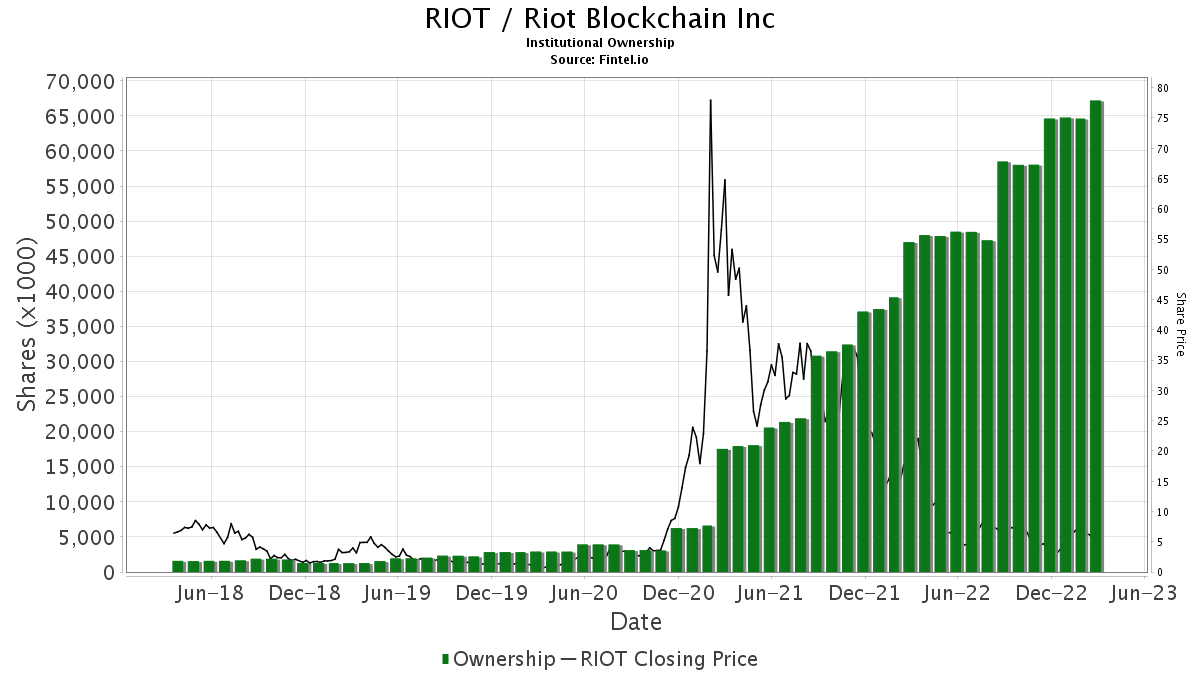

What is fund sentiment?

There are 398 funds or institutions reporting positions in Riot Blockchain. This is an increase of 9 owner(s) or 2.31% over the last quarter. Average portfolio weight of all funds dedicated to RIOT is 0.26%, an increase of 6.84%. The total number of shares held by institutions has increased over the past three months by 4.79% to 67,857,000 shares.

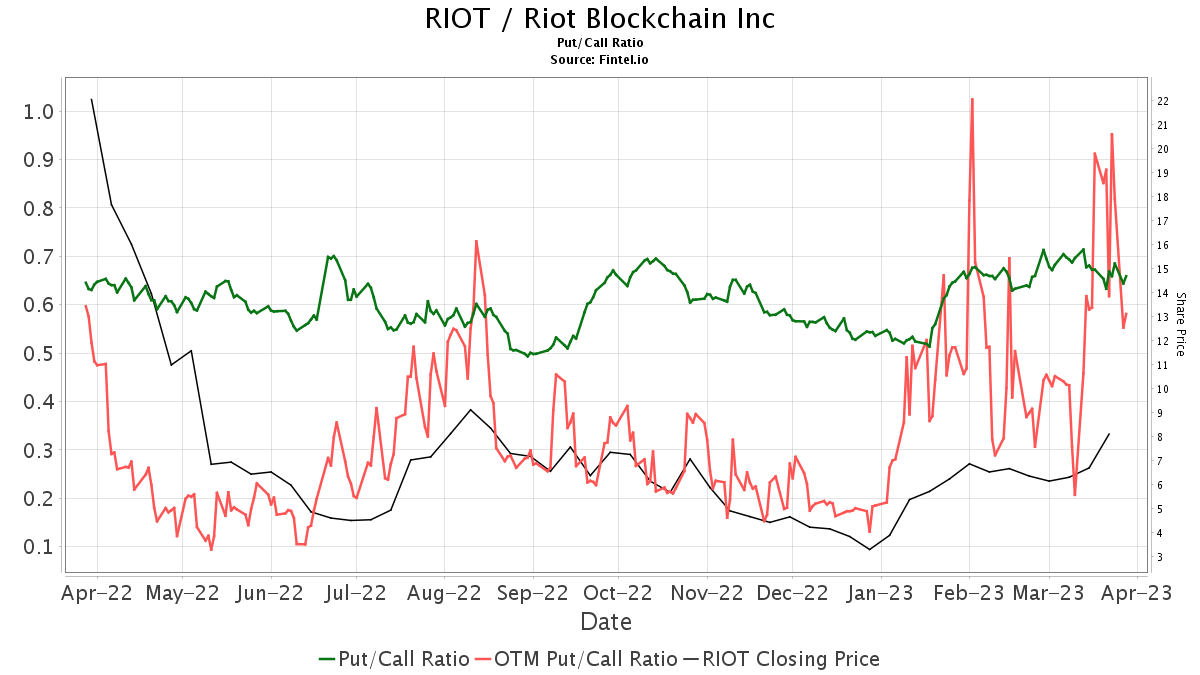

RIOT’s put/call ratio is 0.65, indicating a bullish outlook.

Riot blockchain background information

(This description is provided by the company.)

Riot Blockchain focuses on bitcoin cryptocurrency mining. The Company is expanding and modernizing its mining operations by obtaining the most energy-efficient miners currently available. Riot also has some non-controlling investments in blockchain technology companies. Riot is headquartered in Castle Rock, Colorado, and the company’s main mining facility operates in upstate New York under a colocation hosting agreement with Coinmint.

See all Riot Blockchain regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.