All everyone apparently wanted to talk about in 2020 and 2021 was cryptocurrency. With the price of every digital currency going “over the moon”, for a while there it seemed like all you could do was earn by owning crypto tokens. It was this dynamic that provided the clearest signal that this sector of the economy was turning into a speculative bubble.

The cryptocurrency bubble burst with a vengeance throughout 2022, with an estimated $2 trillion in value wiped out in just a few quarters. This shouldn’t be so surprising if you recognize that cryptocurrencies have generally not proven to be stable investments. For some (including me), they are the equivalent of magic beans with no underlying intrinsic value and were apparently created just to suck money out of your retirement nest egg.

Long-term investors would be better off avoiding the cryptocurrency space. A better option with much more assured potential is to invest in these three video game stocks. They have what it takes to build long-term wealth.

1. Electronic arts: dominance in sports games

My first, and perhaps favorite, video game company to follow is electronic arts (EA 0.24%). The games publisher has been an industry leader for decades, first with sports titles like FIFA Soccer And Madden NFL but now more and more in non-sports titles like Apex Legends, The SimsAnd Star Wars Jedi: Survivor. Riding the tailwind of video game consumption over the past few decades, EA is one of the best-performing stocks of all time, with a total return of nearly 27,000% since its IPO a year ago. over 30 years.

EA has two big developments for investors to watch this year. First of all, it has a huge sequel title called Star Wars Jedi: Survivor launching at the end of this month. His predecessor, Star Wars Jedi: Fallen Order, sold at least 10 million units (EA didn’t disclose the exact number) when it launched a few years ago, and it’s possible the sequel could top that commercial feat. At a retail price of $70, 10 million units sold equals hundreds of millions in gross revenue for EA, which could lead to significant consolidated growth this fiscal year.

The second major event for EA shareholders to watch is its transition for its football title – its most lucrative franchise – from the name FIFA Soccer For EA Sports FC. EA parted ways with the world’s football governing body last year after FIFA demanded a huge price increase to license the FIFA name, taking all of the world’s leagues with it. Investors should know if FIFA chooses another partner to try to create a video game under its name or if EA can maintain its monopoly position in the industry. If so, that’s great news for shareholders.

If EA can continue to launch innovative titles like the star wars jedi series and continues its dominance in sports games, the title will likely perform consistently for long-term shareholders.

EA Total Return Level Data by YCharts.

2. Nintendo: finally expanding beyond games?

By far, the most interesting (and most mysterious) company in the video game field is nintendo (NTDOY -1.75%). Dominating the industry for decades, the Japanese hardware manufacturer and inventor of the mario, ZeldaAnd animal crossing franchises plays by its own rules and has built a family gaming empire in the process.

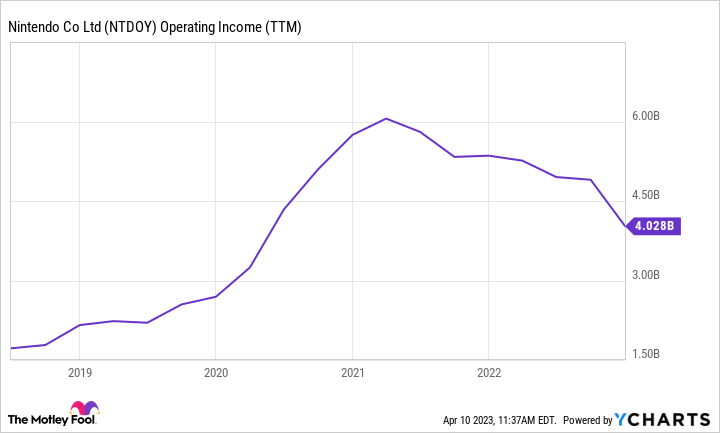

Historically, Nintendo has limited its world-renowned franchises to video game content. It’s quite lucrative, especially when combined with its own video game hardware peripherals. Since the start of 2020, Nintendo has generated more than $3 billion in annual operating revenue and hit $4 billion in profit over the past 12 months, even as the Japanese yen depreciated sharply against the dollar. American.

But now Nintendo has taken steps to expand beyond gaming into new categories of entertainment. She has just released an animated film co-produced with Illumination Studios titled Super Mario movie which is poised to hit over $1 billion in box office sales and become one of the highest-grossing animated films of all time. In collaboration with ComcastOwned by Universal Studios, it is also opening four Nintendo-based theme parks around the world this decade.

Combine those other two entertainment categories with the profitable gaming business, and I think Nintendo will be a strong stock for years to come.

NTDOY Operating Revenue (TTM) data by YCharts.

3. Activision Blizzard: Merger Arbitration and a Reborn Studio

My final pick is in a bit of a sticky spot but, nonetheless, it’s designed to bring positive returns to shareholders. It is ActivisionBlizzard (ATVI -0.19%)one of the largest video game publishers in the world, currently being acquired by Microsoft (MSFT -2.63%) for $95 per share. Today, Activision is trading at a price of $85, which means investors can earn a 12% return in just a few months if the deal closes on schedule this summer.

You can’t precisely quantify the likelihood of global regulators approving the acquisition, but from my seat it seems increasingly likely. Major European regulators wrote favorably of the deal after Microsoft promised to distribute Call of Duty for at least 10 years on all major platforms that compete with its Xbox gaming ecosystem, such as sonyfrom PlayStation, Steam, Nintendo and Nvidia. There is still some uncertainty here; If you follow the industry closely, you will understand that there are no anti-competitive concerns with this agreement. Xbox is significantly behind PlayStation, Steam, and Nintendo among active gamers, so it’s not a dominating industry leader trying to carve out a monopoly position.

Even if the merger is not approved this summer, I think it’s a “heads I win, tails I don’t lose” situation. For what? Because Activision’s business seems to be in great shape compared to a few years ago. Its mainstay Call of Duty franchise is running at full speed right now, the mobile studio King continues to show consistent revenue and profit growth, and its studio Blizzard has a huge lineup of games in the pipeline, including the highly anticipated Diablo IV title. Over the long term, I think that means consistent cash flow generation that Activision can return to shareholders, making the stock a great choice whether or not the deal is approved by regulators.

Brett Schafer has positions in Electronic Arts and Nintendo. The Motley Fool holds positions and recommends Activision Blizzard, Microsoft and Nvidia. The Motley Fool recommends Comcast, Electronic Arts and Nintendo. The Motley Fool has a disclosure policy.